Occupational retirement benefits are an important part of your retirement provision. But how do they work and what are the differences between the 1st, 2nd and 3rd pillars? Here are the most important features.

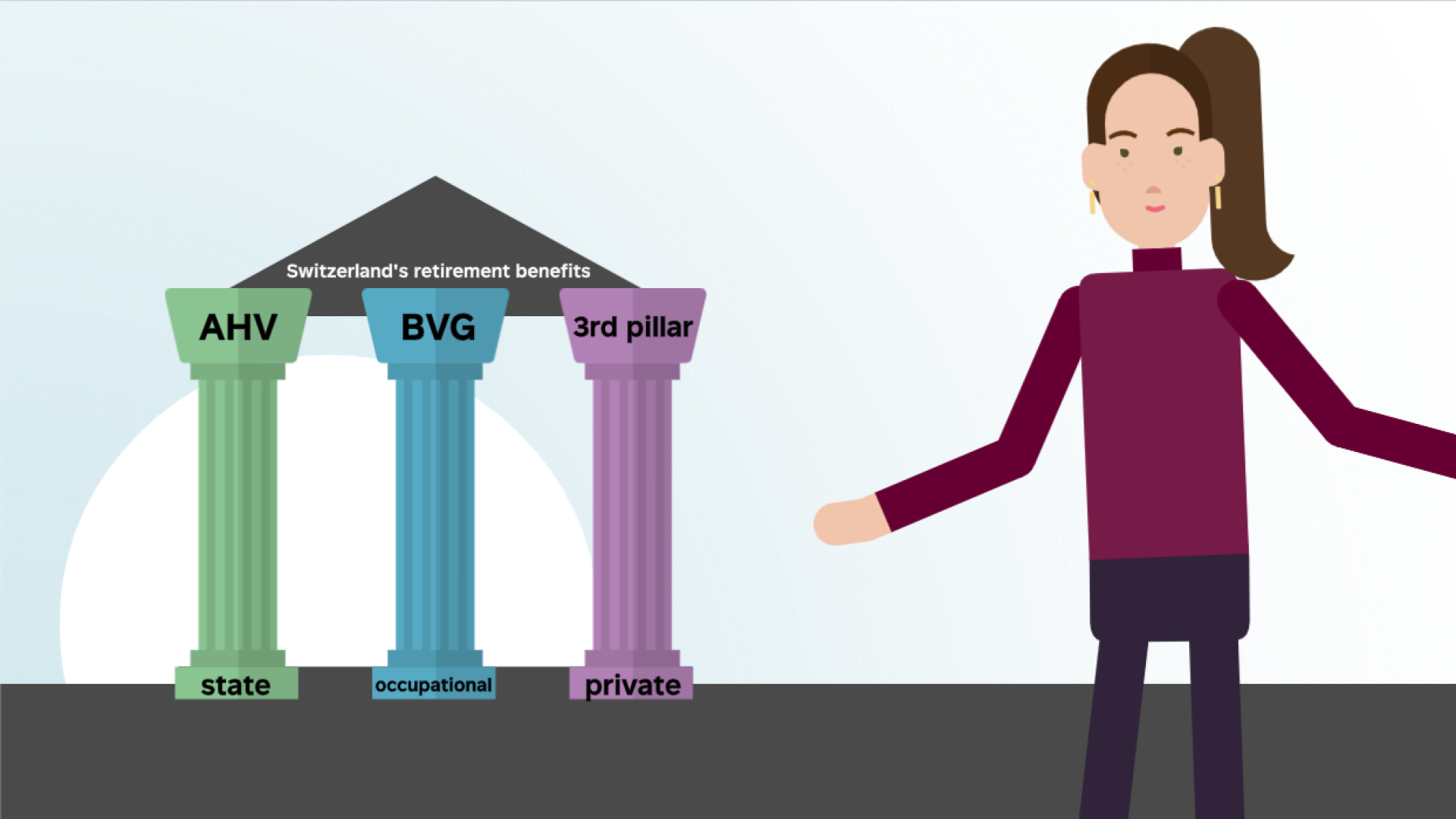

Switzerland’s 3-pillar system

The Swiss pension system consists of three pillars, which together form your occupational benefits. The first pillar is the Old-age and survivors' insurance (AHV). The second pillar covers occupational retirement benefits (BVG), also known as your pension fund. The third pillar is private provision. You can make payments to this voluntarily to improve your pension provision.

Key Terms

Old-age and survivors' insurance is the state's basic insurance for retirement and disability in Switzerland. You will normally pay into this automatically once you are employed.

Occupational retirement benefits, also known as the second pillar or pension fund, are used to ensure your living standards in retirement. You will pay into this automatically as soon as your salary is higher than the coordination deduction.

The coordination deduction refers to the salary share for which no contributions to the occupational retirement benefits need to be made. The coordination deduction is stipulated by law. However, employers may voluntarily reduce the coordination deduction and/or adjust it according to the level of employment. This has the advantage that more money is saved automatically, which is particularly relevant for lower salaries and working hours.

The pension fund is an institution that delivers the occupational retirement benefits. It manages the assets of the insured and ensures that the pension assets are invested well and attract interest for the benefit of the insured. The pension fund pays benefits upon retirement, disability or death. We, Profond, are a pension fund.

The pension certificate is issued by the pension fund and provides an overview of your individual occupational retirement benefits situation. We recommend that you file the current pension certificate with your important documents. You can find your pension certificate on ProfondConnect.

The third pillar of occupational benefits includes private pension schemes that can be used individually to increase financial security in retirement. Providers of 3rd pillar solutions are typically banks or insurance companies.

Have you been looking for a new job? Think about the pension fund, too!

For many people working in Switzerland, the pension fund is the most important pillar for your financial protection in retirement. Changing jobs offers the opportunity to get better pension benefits – and, as a result, more money in the long term.

It is, therefore, worth raising the following questions with a potential employer:

-

Savings contributions: How much of the salary is saved in the pension fund? The following minimum contributions are required by law:

- between 25 and 34 years of age: 7%

- between 35 and 44 years of age: 10%

- between 45 and 54 years of age: 15%

- between 55 and 65 years of age: 18%

Each additional percentage point enhances your financial protection over the long term. In addition, an employer may pay more than half of the amount specified. This is also worth clarifying, as this would mean more money for you.

- Part-time working arrangements: By law, your entire salary is not insured, but only a part of it, since a fixed amount (the coordination deduction) is deducted first. This is particularly disadvantageous in the case of part-time positions. Ask whether the coordination deduction is adjusted to the level of employment or is omitted entirely. Without the deduction, your entire salary is insured, which means you need to make higher contributions – but also receive more money in retirement.

- Interest rate: What was the average interest rate on retirement assets in recent years? A good interest rate helps to build more capital over the long run.

- Protection: What benefits are available in the event of disability or death?

If you want to actively optimise your pension plan, you should ask:

- Elective savings plan: Can you pay in more voluntarily?

- Purchase into the pension fund: What happens to voluntary purchases in the event of your death?

Depending on your age and life situation, you could also clarify the following:

- Insurance during breaks from employment: Will unpaid leave continue to be protected?

- Life partnership: Can I have my partner be my beneficiary at the pension fund, even if we are not married? If so, under what conditions?

- Salaries above the BVG maximum salary: Are higher incomes insured? You can find the “upper limit on the annual salary” here.

- Occupational benefits from age 50: What is the conversion rate and are there flexible retirement models?

- Young employees: Can you start saving before age 25?

Remember: If you change your employer, you should not only discuss your salary, but also the pension fund. The best thing to ask is whether it would be possible to receive the pension fund regulations, the pension plan and a test pension certificate.

Don't forget!

Remember to transfer your retirement assets (vested benefits) to the new pension fund every time you change your job. Find out how to do this here.

Occupational retirement benefits podcasts

Robert Nowacki as guest at FinanzFabio

“Worauf du bei einer Pensionskasse achten solltest”

Listen now (Only in German)

Christiana Smith as a guest at MoneyMatters

“Was macht eigentlich eine Pensionskasse?”

Listen now (Only in German)

Further information