As a pension fund, we have a responsibility – and this extends over many generations. This is why sustainability is central to our investments, in the pensions sector and in operational business.

Sustainability at Profond

For Profond, sustainability means: investing sustainably, conserving the environment and its resources, promoting employees and treating our fellow human beings with respect. These values are an integral part of our business strategy and corporate culture.

As a pension fund, we make an important contribution to financial security in the third stage of life, in the event of disability and death. This is only possible with a sustainable return, which we achieve thanks to our long-term real value strategy. The financial security of those persons insured with us is, therefore, at the heart of our activities. At the same time, we are aware of our responsibility to the environment, society and future generations and take environmental, social and governance factors (ESG criteria) in our investments.

Sustainability in brief

- Our activities focus on achieving sustainable returns in the long term.

- We exercise our voting right at general meetings.

- We want to become carbon neutral in real estate that we hold directly by 2050 at the latest.

- We engage in dialogue to encourage companies to become more sustainable.

- External providers review our portfolio for ESG criteria on an annual basis.

Areas of sustainability strategy actions

Since 2018, sustainability has been one of the strategic pillars of our corporate management. This is, therefore, important not only in our investments, but also in our pensions sector and operational business. Our sustainability strategy covers all of our activities and areas of action.

The areas of action and priorities identified are integrated into our day-to-day operations and are reviewed, implemented and adjusted as necessary in a continuous process. Based on the positive experience gained by Profond with initial measures in the area of sustainability, in 2018 we decided to maintain, expand and consolidate this in Vision 2026.

In 2021, we published a separate publication on sustainability for the first time. An overview of the next steps in real estate, equities and stewardship followed in 2022 and in 2023 we focused on our sustainability efforts in the directly-held real estate sector in an additional publication. From 2024 onwards, our reporting will be based on “ESG reporting: a standard for pension funds” from the Swiss Pension Fund Association ASIP.

We take our responsibility to the insured, employees, society and the environment seriously. For the companies we invest in, we rely on dialogue to encourage them to be more sustainable.

Responsible investing

Equities: high ESG standards

For more than 20 years, we have invested at least 40% of our fixed assets in equities – and have done so successfully. Since the foundation of Profond in 1991, our insured persons have benefited from an average return of 5%. That is why we remain committed to this strategy for the future. The strategy and allocation of the managed pension fund assets are critically reviewed and, if necessary, corrected every three years.

When investing client funds, we case our decisions on ESG criteria environment (E), social (S) and governance (G). In addition to the economic investment objectives such as the rate of return and security of the investments, we also take ethical and sustainable values into account. This is confirmed by our annual systematic ESG portfolio analyses conducted by external providers. Our portfolio of equities and bonds now has an AA rating of 7.4 points (Environmental, Social and Governance Score, MSCI data base as of 31.1.2025).

We follow a best practice approach based on a holistic view of returns and impact in our investments. We follow the guidelines of the Swiss Association for Responsible Investment (SVVK-ASIR) when identifying exclusions. We also support the Swiss Sustainable Finance initiative. This calls on index providers to ban manufacturers of controversial weapons from the main indices. As a member of the Swiss Pension Fund Association (ASIP), we also require our asset managers to comply with its code of conduct (ASIP Charter).

We invest directly in Swiss equities. We actively exercise our responsibility and role as an investor and have been exercising our voting rights at general meetings since 1999. We rely on the voting recommendations from external service providers, such as “Inrate” for Swiss equities and “ISS” for foreign equities. In the case of sensitive securities, the recommendations are internally tracked and reviewed again. We do not invest in commodities and do not speculate on foodstuffs.

Approximately 90% of our equity investments and alternative investments meet the United Nations (UN) Principles for Responsible Investment (PRI) criteria. The proportion of so-called stranded assets, i.e. positions that do not meet the ESG criteria, amounts to less than 1% of assets under management and will be reduced further. With regard to the exclusion criteria for individual securities, Profond follows the official guidelines of the Swiss Association for Responsible Investment (SVVK). The aim of the SVVK is to support its members in their overall responsibility to the environment, society and the economy.

Profond is a member of the “Responsable Shareholder Group” and the “UBS Climate-Aware Solution”. By participating in these engagement pools, we enter into an active exchange with companies to improve their climate strategy and increase transparency concerning their climate risks.

Direct contribution to the energy transition

We are also making a direct contribution to the energy transition with our majority shareholding in Agro Energie Schwyz AG. Agro Energie Schwyz AG, which has been nominated for the 2020 Environmental Award, produces carbon neutral green electricity and heat from natural regional biomass. By doing so, the company is promoting regional independence, creating jobs and reducing the use of fossil fuels and electricity to generate heat.

Real estate: Target carbon neutrality

Investments in directly held real estate make up around 20% of our portfolio. We aim to be carbon neutral for real estate held directly by 2050 at the latest. According to the current model, the carbon emissions from our domestic real estate are even falling significantly faster than the federal government's target. When acquiring and renovating real estate properties that we hold directly, we take into account both economic and environmental and functional aspects. With ongoing and comprehensive renovations, we are reducing carbon emissions, while at the same time paying attention to long-term returns. We develop and review our ESG and climate measures with our external partner Wüest Partner.

Report of the Profond Investment Foundation 2023

This publication shows our efforts in the area of sustainability.

Engagement – our memberships

To maximise its impact, we are focussing our sustainability efforts on those asset classes that we can influence directly. This enables us to implement effective measures independently and monitor their effectiveness in a targeted manner. For those asset classes in which we invest indirectly, we ensure that companies meet high standards in ESG criteria. We also support the environmental transformation of companies with high carbon emissions that have a clear plan to reduce these emissions. Our special commitments:

As a member of the Responsable Shareholder Group, we have been engaged in an active dialogue with companies since 2022 to improve their climate strategy and increase transparency with respect to their climate risks. In this way, we remain committed to effective change and support companies on their path to sustainability. This is in contrast to the exclusion of an equity where there is no incentive for change.

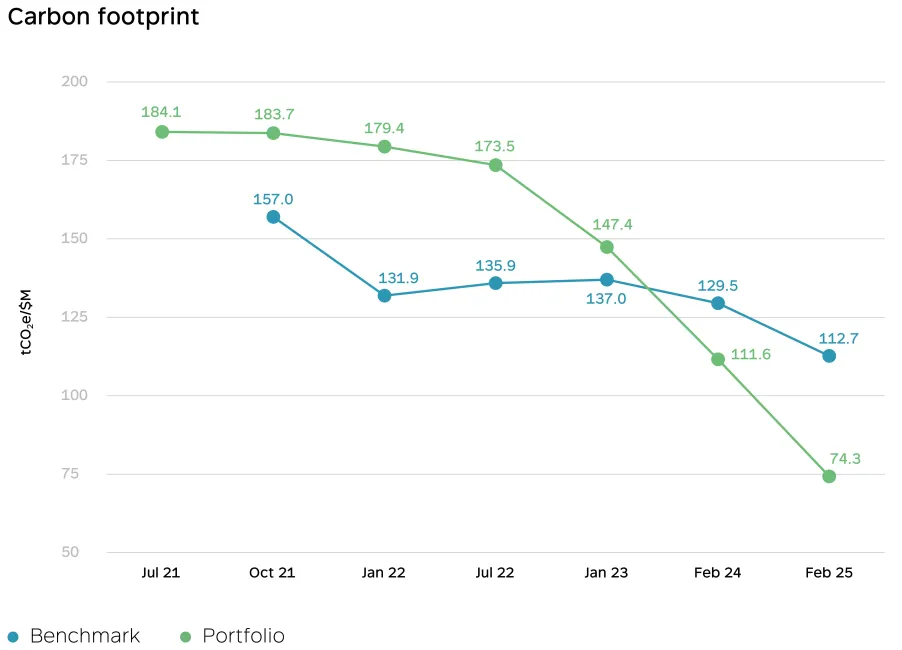

In 2022, we expanded our climate exposure further by converting our Equity-World portfolio of over CHF 2 billion to a more climate-friendly investment solution. By switching to the “UBS-Climate-Aware solution” exposure pool in the “Equity World ex Switzerland” segment, we were able to reduce the carbon footprint (intensity) for the Equity-World portfolio by 44 per cent. The climate engagement of UBS also includes dialogue with companies. The focus is on those areas, where specific climate change challenges have been identified, with a small number of companies being responsible for a large share of carbon emissions. The engagement process aims to improve companies’understanding of their risks associated with climate change.

Exercise of voting rights

Key figures

The climate indicators are based on ASIP ESG reporting: Standard for pension funds (excluding stewardship) and were collected by Credit Suisse AG, part of the UBS group, Investment Solutions & Sustainability | ESG Strategists & Analytics.