Profond impresses with above-average asset accumulation and generous benefits in the event of death. This is how you and your employees benefit.

Above-average interest rate

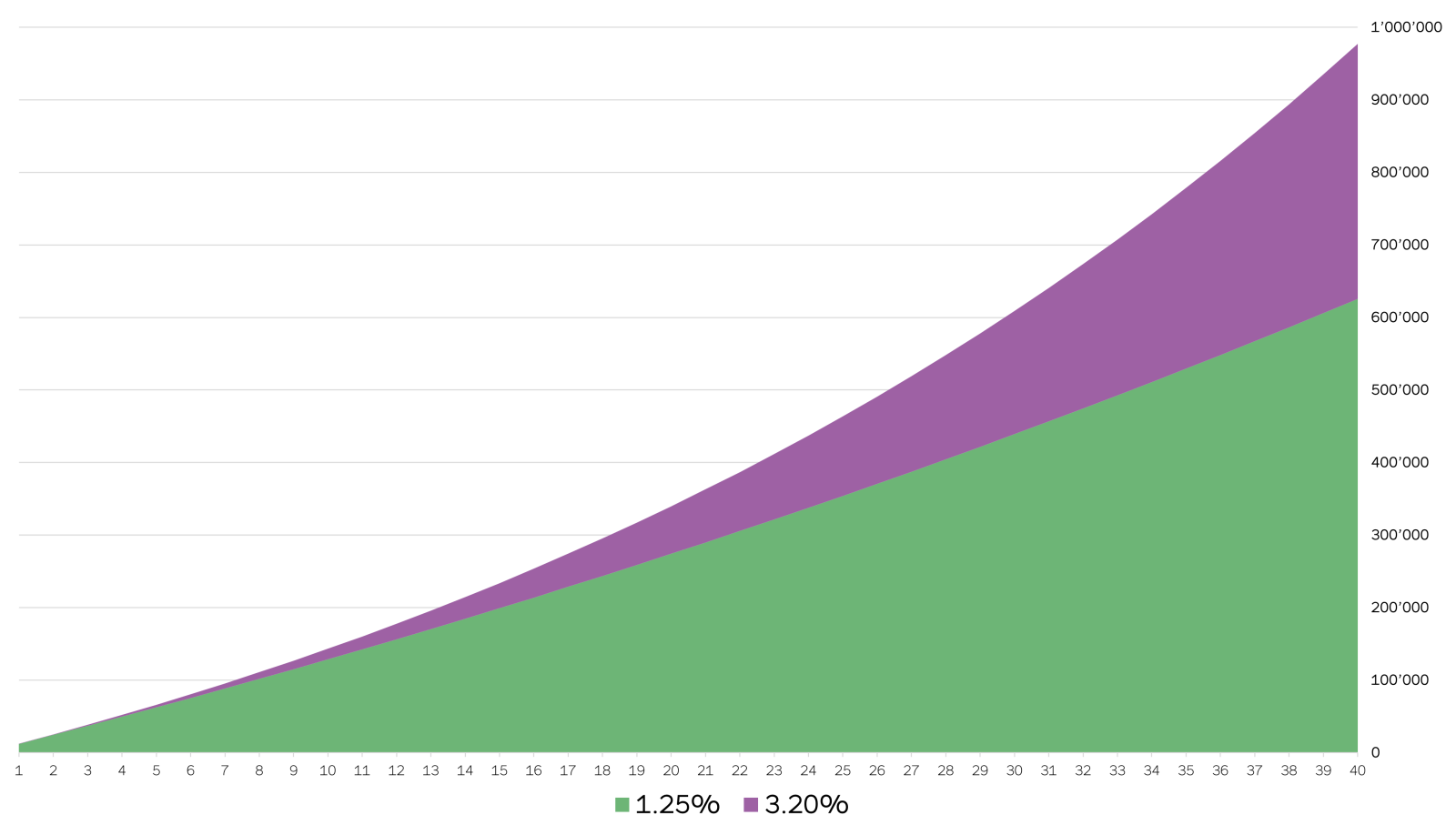

Profond has been paying interest on retirement assets at an above-average interest rate for years. Due to the long investment horizon (a whole working life), the compound interest effect is remarkable .

Here is a calculation example: The monthly savings contributions to the pension fund amount to CHF 1 000. The money saved earns interest at the statutory minimum interest rate of 1.25% (green area) and at the more attractive interest rate of 3.2% (violet area). This is the average interest rate Profond has paid on the pension fund assets of its policyholders over the last ten years. After 40 years, the retirement capital is therefore significantly higher:

- CHF 622 360.58 at 1.25% annual interest rate

- CHF 971 444.09 at 3.2% annual interest rate

- Profond members save CHF 349 083.50 more in 40 years

For an investment horizon of 20 years, the difference between the minimum interest rate and an interest rate of 3.2% is still slightly more than CHF 50 000.

The interest rate has a decisive influence on wealth creation and thus on your standard of living in old age.

Unique in Switzerland: Our generous benefits in the event of death

If a person insured with Profond dies before retirement, in addition to the usual benefits, the surviving dependants will also receive the entire accrued retirement assets as a lump sum payable at death. This includes all deposits made with Profond or previous pension funds. In addition, the pension plan may provide for a further lump sum payable at death.

Lump sum payable at death for beneficiaries of persons receiving a pension

In the first three years after the start of the pension, surviving dependents of an insured person receive a lump sum payable at death.

Lump sum payable at death for beneficiaries of persons with a disability pension

Surviving dependants of a person who received a disability pension are also entitled to a lump sum payable at death. As a result, they are better secured financially.

Additional lump sum payable at death for beneficiaries on deferred retirement

Surviving dependants of pensioners who retired later than required by law will also receive a lump sum payable at death. This rewards the longer contribution payment and the later withdrawal of pensions.

Detailed information can be found in the Profond Pension Fund Regulations.