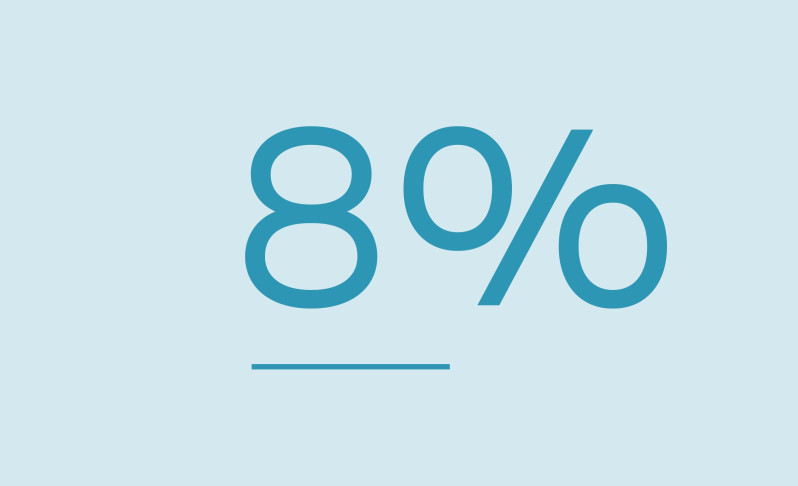

Profond achieved a very good provisional total return of 9.6% in 2024 and pays interest on the retirement assets of its insured members at 8% – well above the BVG minimum interest rate of 1.25%.

Real value strategy has also proven itself in 2024

The above-average interest rate is based on the proven real value strategy, with which Profond achieved a provisional total return of around 9.6% and a provisional funding ratio of 110% in 2024. This result demonstrates Profond’s continued financial stability and resilience. “We are pleased to be able to offer our insured members an interest rate well above the statutory minimum interest rate this year. Our investment strategy, which relies heavily on real value such as equities and real estate, was once again very successful last year,” says Laurent Schlaefli, Managing Director of Profond.

Thanks to the constantly positive returns, Profond has been able to pay interest on the retirement assets at an average of 4.5% over the past five years. Profond’s insured members thus benefit noticeably from the so-called “third contributor” – the compound interest effect.

Long-term stability and safeguarding the future

Profond attaches great importance to meeting its financial obligations in the long term and ensuring the prosperity of its insured members during the third stage of their life. The Foundation Board has therefore decided to use part of the return to strengthen the value fluctuation reserve and to pass on the greater part to the insured members by paying interest on retirement assets of 8%.

You can find monthly updated key figures here.

Constant conversion rate

The Profond Foundation Board has also decided to keep the conversion rate constant for the years 2025, 2026 and 2027. In this way, it is creating clear and reliable conditions both for customers and partners.

Innovative new features for more flexible use of the 2nd pillar

With the 2025 Pension Fund Regulations, Profond is again introducing innovations in order to improve benefits for its insured members and their surviving dependents. The main changes include:

- Beneficiary order: Now, certain categories of beneficiaries can be combined and moved in order, allowing insured members to share their lump sum payable at death more flexibly. Detailed information and instructions on how to complete the beneficiary regulation can be found at profond.ch/en/arrangements-death.

- Partners with separate residences: From 2025, insured members can register their partner with Profond even without a common place of residence in order to secure their entitlement to a survivors' benefit. The requirements are listed in the corresponding information sheet at profond.ch/en/marriagepartnership.

- Pension with capital protection: Insured members can now choose a pension with capital protection, which is valid for ten years or at the latest until the 75th year of life. You can find information on this in the corresponding information sheet at profond.ch/en/retirement.

You can read the full press release here.

Profond pays interest on the special accounts (uncommitted funds and employer contribution reserves) at 1.25% in 2024. We recommend distributing the uncommitted funds so that the insured members will benefit from the higher interest rate.