The Profond Investment Foundation aims to achieve sustainable growth and is continuously expanding its real estate portfolio.

The Profond Investment Foundation at a glance

Founded in 2016, the investment foundation is a legally independent entity owned by the Profond Pension Fund. We actively invest in real estate in Switzerland and Germany. Our real estate portfolio includes residential, business and logistics properties and has a market value of around 2.5 billion Swiss francs (as of December 2024).

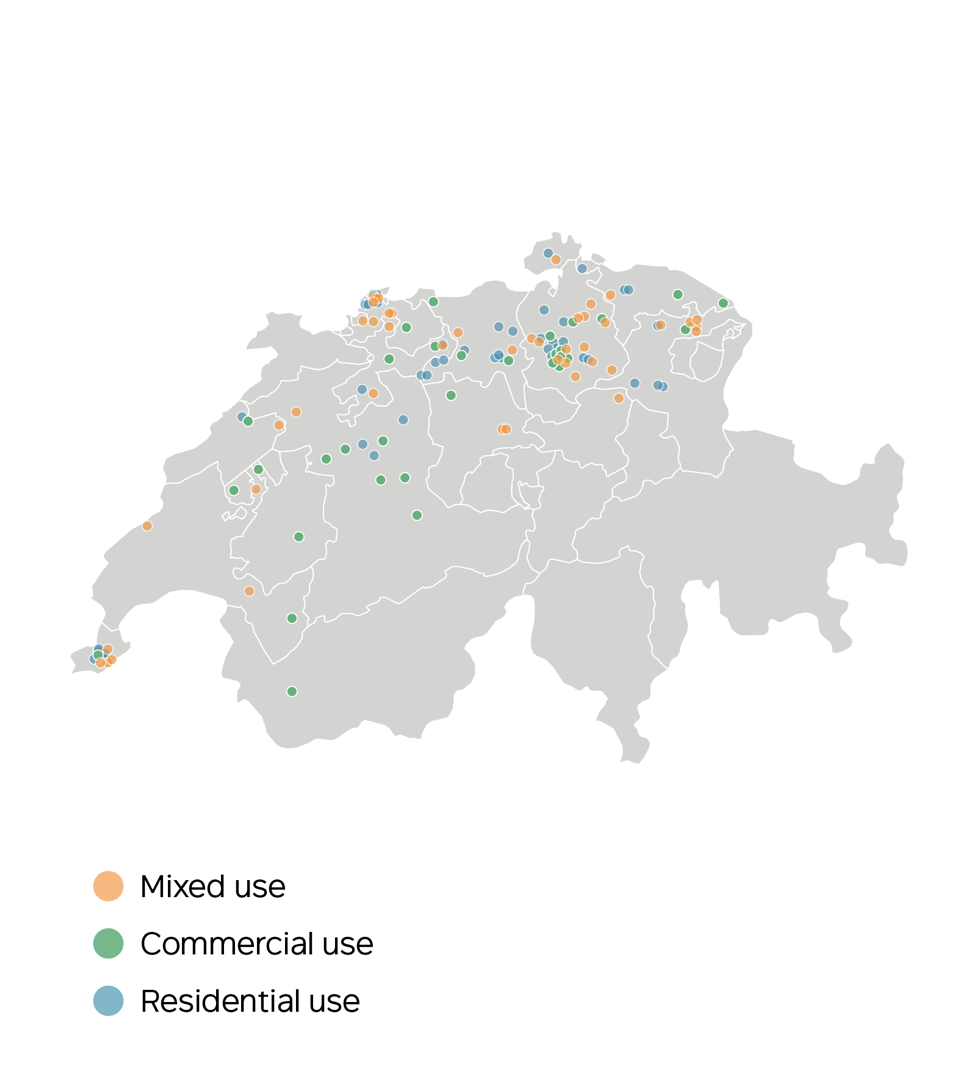

Where our properties are

Real estate in Switzerland, market value approx. CHF 1.9 billion. (31.12.2024)

Real estate in Germany/Austria with a market value of around EUR 0.5 billion. (31.12.2024)

We invest sustainably and for the long term

In addition to economic aspects, we also incorporate environmental and social criteria when making our investment decisions. We have a long-term perspective that takes into account the total life-cycle costs, meaning both investment costs and operating and maintenance costs. We invest exclusively in locations that are attractive in terms of sustainability, for example through good public transport connections.

Do you have any attractive offers for us?

We like to consider attractive real estate investments in existing properties, although real estate properties with challenges, such as increased levels of vacancy or greater investment requirements, may also be of interest to us. Otherwise, we would like to acquire developed projects or develop them together with partners – perhaps soon with you?

Our key investment criteria:

Investment segments

- Purely residential and commercial properties

- Mixed real estate properties with residential, office, commercial, logistics or sales use

- Types of serviced accommodation (no hotels)

Target regions

- German Switzerland: With a focus on BL, BS, LU and ZG, with new buildings or refurbished buildings being preferred in BS

- Western Switzerland: With a focus on the cantons of FR and VD

Location factors

- Central locations with good accessibility and infrastructure

- A positive outlook for the community demographics

Investment volume

- Switzerland: CHF 10-75 million per property

Forms of ownership

- We prefer to invest through sole ownership

- Co-ownership is also possible in justified cases

Building land

- Land with projects developed to maturity, preferably with planning permission in prospect or with planning permission already granted.

Send us your offer:

If your offer meets our investment criteria, please send it directly to re.acquisition@profond.ch. We will review it and get in touch with you. If you have any questions or would like advice, please contact us by e-mail.

Real Estate Transaction Manager

Marcel von der Assen

The Board of the Profond Investment Foundation

Peter E. Bodmer (since 2017), President

Herbert Meierhofer (since 2022), Member

Stephan Schelling (since 2024), Member

The Real Estate Committee, as a strategic committee in the area of real estate, is a body of the Investment Foundation and forms one of the special committees. Profond Pension Fund established the Profond Investment Foundation on 19 January 2016. All directly held properties of the Pension Fund were transferred to this Foundation. Profond Pension Fund is the sole owner of the Investment Foundation.

Number of meetings in the year under review: 5

Members

Herbert Meierhofer, Chair

Peter E. Bodmer, Member

Andreas Häberli, Member

Hansjörg Pedrett, Member