As of 1 January 2021, the handling of incapacity for work has been fully automated. This means that insureds and companies will receive confirmation directly in the ProfondConnect portal.

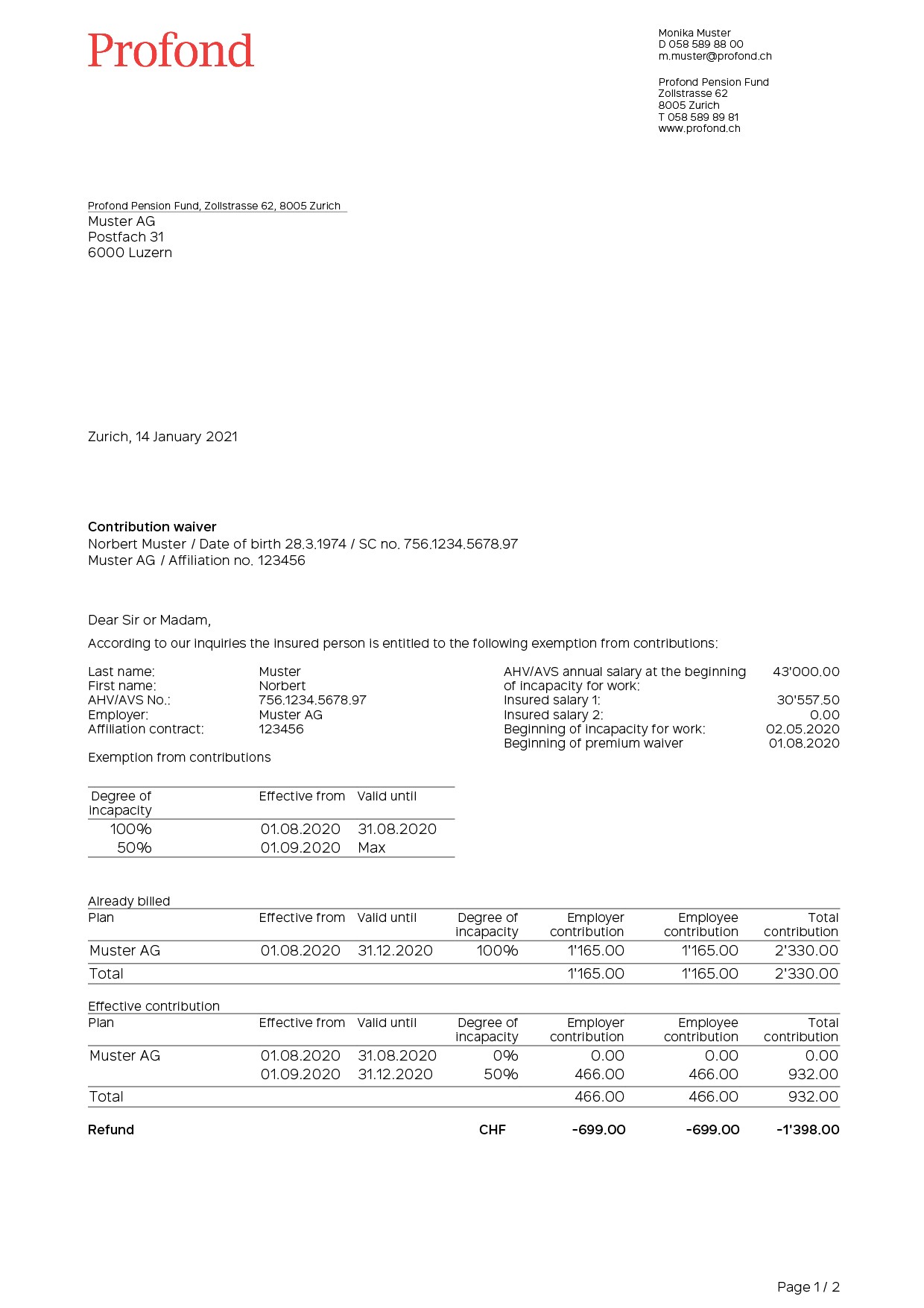

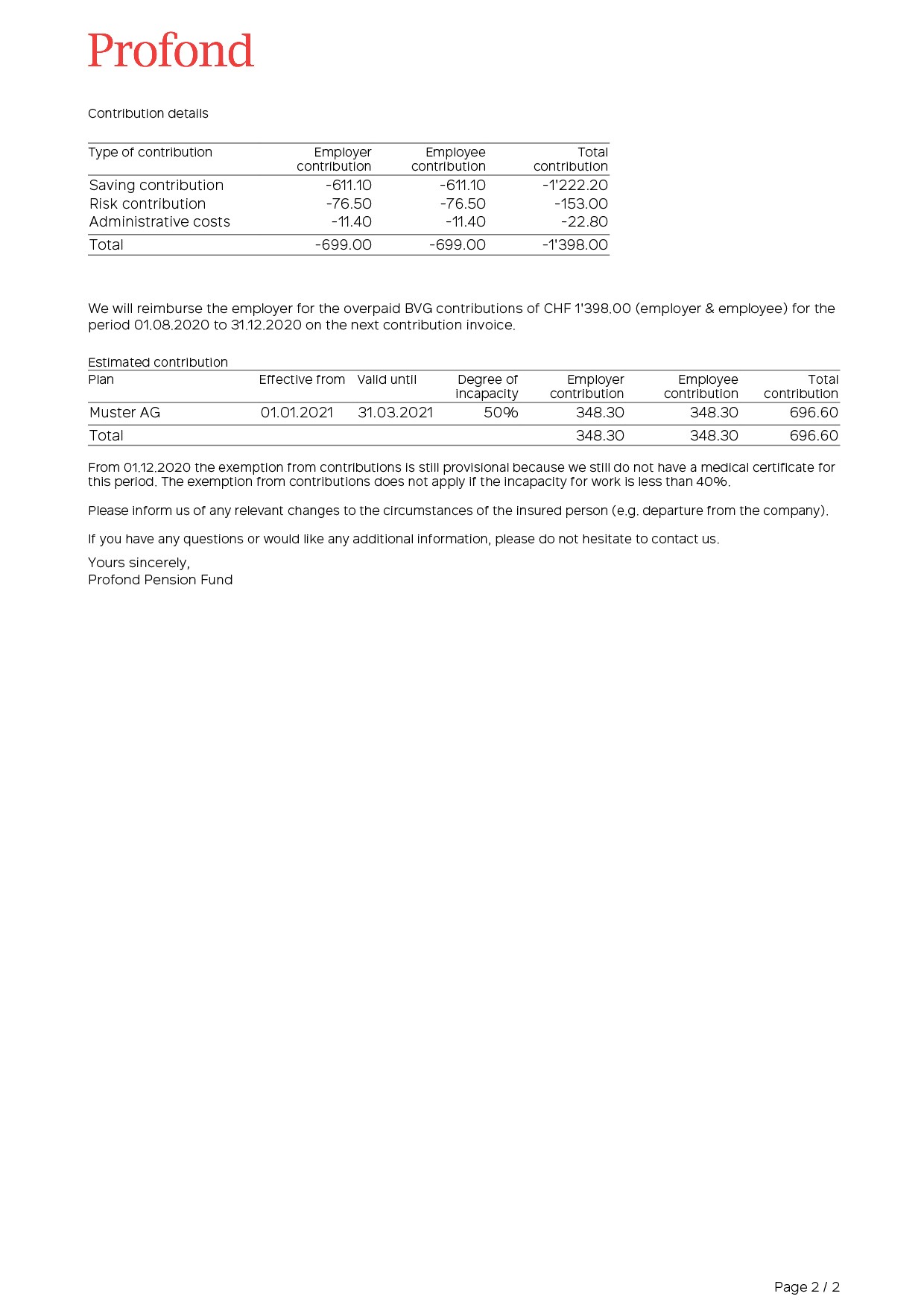

The confirmation explained in brief

After the notification of incapacity the case will be processed by Profond. The company and the insured person then receive a confirmation in the ProfondConnect mailbox. The confirmation contains detailed information such as information on incapacity for work, exemption from contributions or amounts invoiced.

Here you can see the reported incapacity for work as a percentage, as well as the period of exemption from contributions. The end date for this item is listed under “Max”. To see the corresponding date, go to point 7. The date listed under “Max” corresponds to the last day before the provisional exemption from contributions begins.

Under this item you can see what has been charged on the invoices sent for this period so far.

Here you can see the effective contribution based on the reported incapacity for work during this period. Below this, the difference is listed as a credit or a debit.

List of employer and employee contributions for the period mentioned. This shows the employer how much the insured person’s salary deduction is.

Here you can see again clearly listed what will be credited or charged to you on the next invoice.

The estimated contribution shows what employers will have to deduct for the insured in the future. Until Profond confirms the next exemption from contributions, the expected contribution is listed here.

From this date, the exemption from contributions is provisional.